Achieve AML Compliance by meeting the ever-changing regulations set by the FATF

Achieve AML Compliance by meeting the ever-changing regulations set by the FATF

Financial services firms falling short of regulatory standards were hit with £52.8m in fines from the FCA in 2023, exposing gaps in compliance measures.

Streamline onboarding with KYC & KYB

Improve Customer Due Diligence

Automate Transaction screening

Implement robust ongoing monitoring

Solve problematic property verification while streamlining diverse legal frameworks

Solve problematic property verification while streamlining diverse legal frameworks

Estate agents hold the largest number of AML fines issued by HMRC since the introduction of AML supervision, accounting for nearly half (45%) of all fines issued.

Know your property clients

Source of funds identification

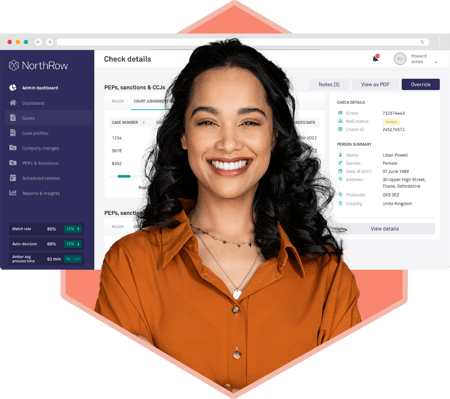

Complete audit trail for AML compliance

Trigger Suspicious Activity Reporting (SARs)

Maintain the integrity of financial systems and prevent illicit activities

Maintain the integrity of financial systems and prevent illicit activities

Demands to manage compliance continue to increase across the professional services sector, particularly legal, accountancy and even telecommunications.

Digitise client onboarding with KYC & KYB

PEP and Sanctions Screening

Ongoing client monitoring

Achieve regulatory compliance

Mitigate the threat of financial crime and terrorist financing to adverse risks

Mitigate the threat of financial crime and terrorist financing to adverse risks

With evolving regulations, individuals and businesses (60%) struggle to achieve compliance; this is no different for the art market and high-value dealers.

Accelerate KYC & KYB processes

Biometric facial recognition

UBO verification & ongoing monitoring

Screening & enhanced due diligence

1,000s

Users globally

500,000+

AML checks every year

98%

Match rate

95%

Auto-decision rate

“NorthRow has been very easy to work with; their approach is professional, transparent and consultative. Their ability to deliver a bespoke solution that combines automated identity checks with the added security of face-to-face verification made them the obvious choice.”

© Copyright 2023 NorthRow All Rights Reserved

View our Privacy Policy